Samsung rides Galaxy A lines' strong sales to remain top smartphone vendor during Q2

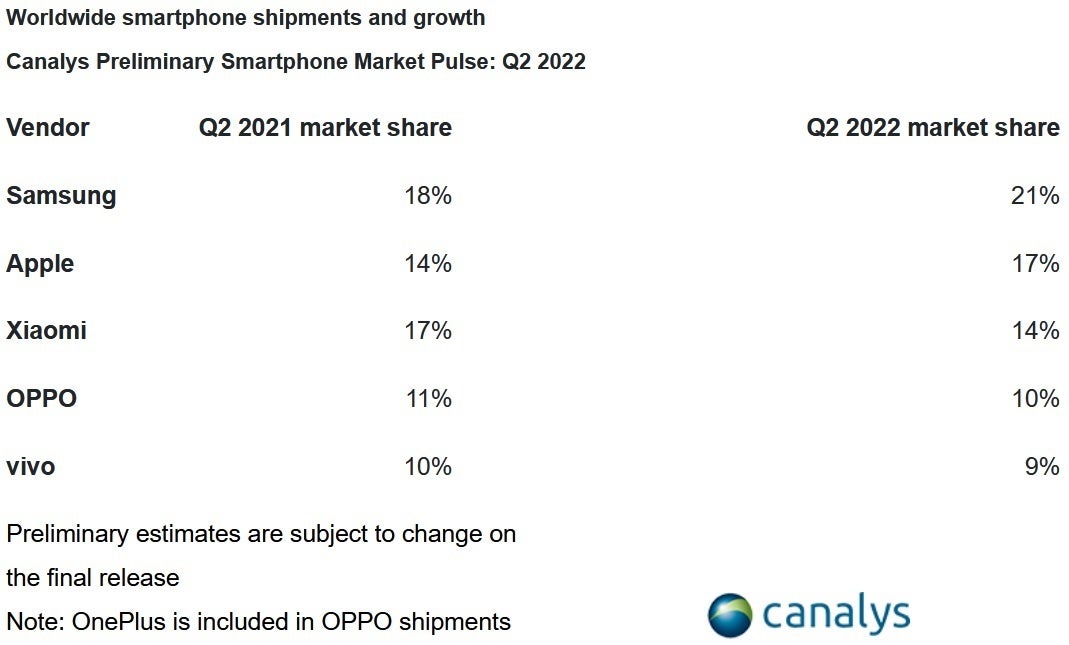

Market research firm Canalys has released its second quarter data showing that smartphone shipments for the period declined by 9% on a year-over-year basis. The firm explained that issues with the global economy were to blame as were certain regional factors. Samsung remained the top smartphone vendor worldwide with a 21% market share thanks in part to strong shipments of its budget-priced Galaxy A series.

The Galaxy A series is made up of lower-priced handsets with viable cameras, large batteries, and overall good performance for the price.

Continued high demand for the iPhone 13 series helped Apple maintain the second highest market share among global phone manufacturers at 17%. China's Xiaomi, Oppo, and Vivo were third, fourth, and fifth respectively. Each of these firms had declines in phone shipments during the second quarter leaving them with global market shares of 14% (Xiaomi), 10% (Oppo), and 9% (Vivo).

Canalys Research Analyst Runar Bjørhovde said, "Vendors were forced to review their tactics in Q2 as the outlook for the smartphone market became more cautious,. Economic headwinds, sluggish demand and inventory pileup have resulted in vendors rapidly reassessing their portfolio strategies for the rest of 2022. The oversupplied mid-range is an exposed segment for vendors to focus on adjusting new launches, as budget-constrained consumers shift their device purchases toward the lower end."

Samsung and Apple each had decent performance during Q2

Another Canalys analyst, Toby Zhu, stated that the supply chain is concerned because of the dropping demand for smartphones. That makes sense of course since lower demand for handsets leads to a decline in the number of units built which in turn reduces demand for the supplies needed to manufacture smartphones. Zhu adds "While component supplies and cost pressures are easing, a few concerns remain within logistics and production, such as some emerging markets' tightening import laws and customs procedures delaying shipments."

"In the near term," Zhu added, "vendors will look to accelerate sell-through using promotions and offers ahead of new launches during the holiday season to alleviate the channel's liquidity pressure. But in contrast to last year’s pent-up demand, consumers’ disposable income has been affected by soaring inflation this year. Deep collaboration with channels to monitor the state of inventory and supply will be vital for vendors to identify short-term opportunities while maintaining healthy channel partnerships in the long run."

For the record, Apple had a leading 21.4% increase in market share on a year-over-year basis. Samsung's year-over-year increase in Q2 market share amounted to 16.7% putting it second behind Apple. Xiaomi lost 17.6% of its Q2 2021 market share in 2022, Vivo lost 10%, and Oppo's second quarter market share during 2022 second quarter slipped 9.1% on annual basis.

Things that are NOT allowed: